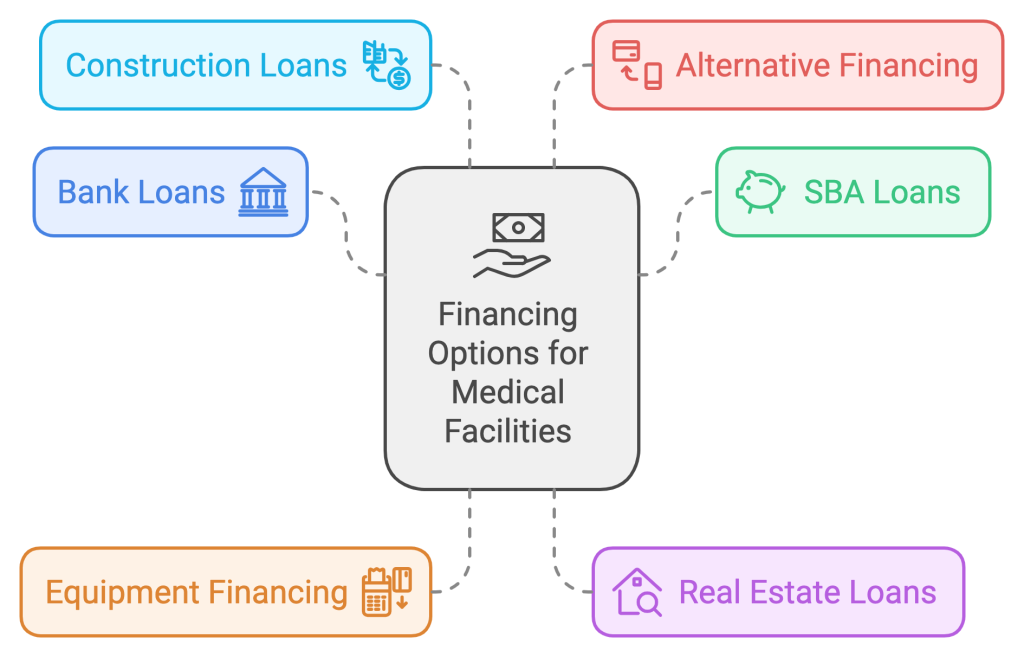

Building a medical facility is no small task, and financing it can feel like a puzzle. With so many options available, it’s easy to feel overwhelmed trying to choose the one that’s right for you. But finding the right financing isn’t just about getting money—it’s about setting up your practice for success in the long run. Today, we’ll break down some of the top financing options to help you make a decision that suits your needs, timeline, and budget.

1. Traditional Bank Loans

For many, traditional bank loans are the go-to choice. They work just as you might expect: the bank lends you money, and you pay it back over time with interest. These loans offer predictable terms and can often come with lower interest rates than some of the alternatives, which is great if you want stability.

Pros: Bank loans tend to have lower interest rates and come with steady repayment plans. If you qualify, they can be a cost-effective choice.

Cons: Traditional bank loans can be tough to secure. Banks usually have strict eligibility requirements, especially when it comes to financing medical facilities. Also, the approval process can take some time, which might not be ideal if you’re in a hurry.

Example: Imagine a small general medical clinic that’s looking for a steady, predictable way to finance their new building. They have solid financials, so a bank loan might be a great fit.

2. SBA Loans for Healthcare Facilities

Small Business Administration (SBA) loans are another solid choice, especially if you’re a smaller practice looking for favorable terms. The SBA works with banks to offer loans with more flexible terms, lower down payments, and longer repayment periods. These features make them a popular option for healthcare practices.

There are a few types of SBA loans to consider:

- 7(a) Loan Program: This is the SBA’s most common loan, used for various business expenses.

- CDC/504 Loan Program: This loan specifically supports the purchase of real estate or equipment.

Pros and Cons: SBA loans generally have more affordable rates and long repayment periods, but they can be tricky to apply for. The process is lengthy, and the paperwork can seem endless.

Example: Say you’re a smaller practice with a tight budget looking to build a new office. An SBA loan could help you get started without a large down payment.

3. Equipment Financing

For some medical facilities, the biggest expenses are related to specialized equipment. Equipment financing is designed specifically for these types of purchases, allowing you to finance items like imaging machines, lab equipment, or surgical tools. With this option, the equipment itself often serves as collateral.

Pros: Equipment loans are easier to qualify for compared to other types of financing, and the funds are typically available quickly.

Cons: The downside is that this financing is limited to equipment purchases, so it won’t cover other construction costs.

Example: Imagine you’re building a new medical practice and need advanced imaging machines. Equipment financing could help you get the tools you need without a large upfront cost.

4. Real Estate Loans for Medical Facilities

Real estate loans are ideal if you’re looking to buy land or purchase an existing building for your practice. These loans offer lower interest rates and are typically spread over a long term, providing a stable financing option.

Pros and Cons: Real estate loans often come with stable terms and reasonable interest rates, but they do require a substantial down payment.

Example: Consider a practice looking to buy a piece of land and build a custom facility from scratch. A real estate loan could help secure the land and make initial construction possible.

5. Construction Loans

If you’re building a facility from the ground up, construction loans could be the right fit. These loans are designed specifically for construction projects and typically offer funds in stages as the project progresses. This staged payout can help you manage costs at different phases of the construction process.

There are two main types of construction loans:

- Single-Close Construction Loans: The loan covers both construction and the long-term mortgage.

- Two-Time Close Loans: You get two separate loans—one for construction, and then a mortgage to pay off the construction loan.

Pros and Cons: Construction loans are tailored for these types of projects, so they can be a good match. However, they tend to have variable interest rates, which can make budgeting a bit harder.

Example: Let’s say you’re planning to open a large facility with specialized rooms for different treatments. A construction loan that provides funds as you need them could be a smart move.

6. Alternative Financing Options

Finally, if traditional loans don’t fit your needs, there are alternative options like bridge loans or mezzanine financing. These short-term solutions can give you access to funds quickly, although they often come with higher interest rates.

Pros and Cons: Alternative financing tends to be faster and more flexible but often comes at a higher cost. These loans can be helpful in specific situations, like when you’re waiting for other financing to come through.

Example: If your practice is growing quickly and you need extra space now, a bridge loan could help you expand while you wait for long-term financing.

Conclusion

In the end, the best financing option depends on your unique goals, budget, and timeline. Each type of loan offers different advantages, so it’s all about finding what aligns with your needs. Consulting with a financial advisor can help you weigh your options and choose the financing that sets you up for long-term success.

Curious about financing options for your medical facility? Let us help you find the right solution! Call us at (954) 710-9100 to explore financing paths that fit your practice’s needs.